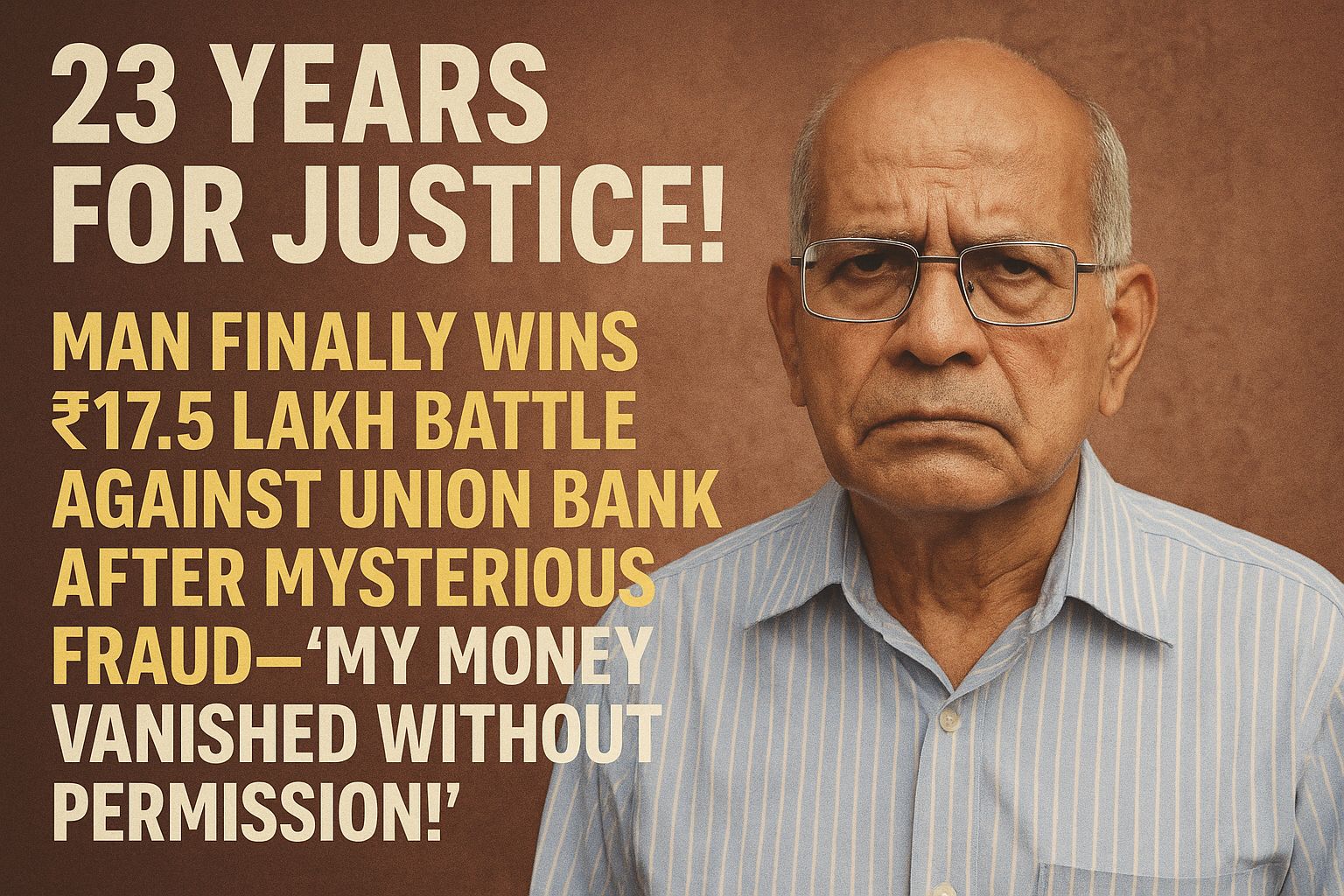

Another landmark judgement strikes in order to preserve and revive the importance of consumer rights, a man finally awarded with ₹17.5 lakh after fighting for justice for 23 years with Union Bank over a fraud . The case has highlighted the loop holes in banking security and accountability which opposes the statement justice delayed is justice denied rather it sets a reminder justice delayed can still be served .

The Incident: Money Vanishes Mysteriously

The case started in 2001 where a complainant residing in Uttar Pradesh eho deposited a amount into the Union bank but found ₹17.5 lakh disappeared. The complainant stated that he did not held any knowledge or neither any authorisation was asked. Multiple complaints were made where no action was took by the bank and refused on their part .

Finding no assistance from the bank he filed a case with the Consumer Forum, demanding an investigation and to get the lost funds. However the battle continued for more than 20 years

The Legal Struggle

The case passed through multiple consumer courts and appeals over the years. At every stage, the bank attempted to refuse the blame, arguing that the transactions were not unauthorised . However, the complainant remained on the statement that no authorisation was asked and no proper alerts were received by him .

Over time, the bank was not able yo produce any evidence which weakend its position. Despite the evidence provided by complainant the system inefficiency kept him waiting for justice over the years.

The Verdict: Relief After 23 Years

Finally, in 2024, the State Consumer Disputes Redressal Commission gave judgement in favor of complainant and directed the bank to compensate the victim ₹17.5 lakh along with interest. ruled in favor of the complainant.

In its judgment, the Commission remarked,

“It is unacceptable that a consumer should have to fight for more than two decades to get justice. The bank failed in its duty to secure the customer’s funds and must be held accountable.”

The ruling has been widely hailed as a major victory for consumer rights and a stern warning to banks to tighten their internal systems and improve grievance redressal mechanisms.

Wider Implications

Consumer rights advocates have emphasized that this case should serve as a precedent. It reinforces the idea that banks are not immune from scrutiny and must treat all fraud-related complaints with seriousness, regardless of the amount or the time elapsed.

Conclusion

For the man who waited over two decades for a verdict, the battle was as also about his principle along with money.

“It wasn’t just about the ₹17.5 lakh. It was about proving that I wasn’t wrong. I feel vindicated today,” he said after the verdict.

While the ruling brings closure to one victim, it also opens a new chapter in the ongoing dialogue about consumer protection, financial fraud, and the need for accountability in India’s banking system.

About the author

Chetna is a 3rd-year BBA LLB student at Maharishi Markandeshwar University, Mullana. With a passion for law, policy, and current affairs, she actively engages in research and writing on legal developments shaping society. Chetna aims to bridge the gap between legal discourse and public understanding through clear and concise analysis.