The Legal Context: From BCCI Default to Insolvency Proceedings

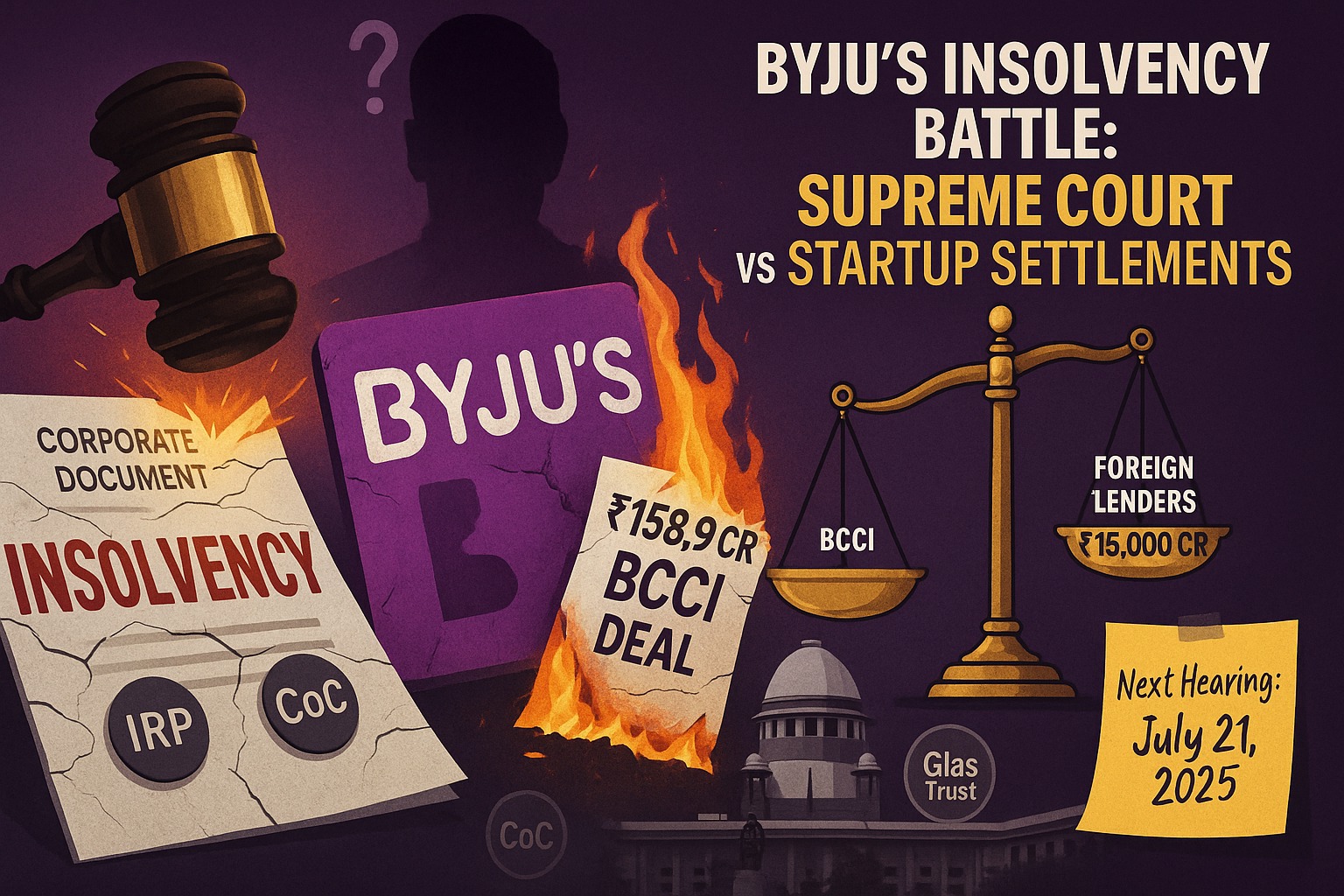

Byju’s education technology company, Think & Learn Pvt Ltd, was placed in insolvency proceedings by the Board of Control for Cricket in India (BCCI) due to nonpayment of ₹158.9 crore in sponsorship fees. The petition was granted in July 2024 by the National Company Law Tribunal (NCLT), which also suspended the company board and appointed an interim resolution professional (IRP).

Byju’s promoters then reached a settlement with BCCI ,the company paid the full amount before the Committee of Creditors (CoC) was formed. Despite this, the NCLAT nullified the proceedings based on that settlement until the Supreme Court intervened. Previously, the apex court set aside NCLAT’s closure of the insolvency process, keeping the matter alive.

Supreme Court Admits Appeals: What Was Heard on May 29, 2025

On May 29, 2025, the Supreme Court admitted two separate appeals: one by Byju’s promoters and another by the BCCI. Both petitions sought to withdraw the Corporate Insolvency Resolution Process (CIRP) based on their pre-CoC settlement. In parallel, the U.S.-based Glas Trust — representing foreign lenders — had opposed the settlement, fearing misuse of loan funds.

During the May 29 hearing, the Supreme Court refused to stay the insolvency proceedings, keeping the IRP and CoC process intact, but directed that all stakeholders respond to the withdrawal pleas.

Key Legal Issues Before the Supreme Court

l The legitimacy of the pre-CoC settlement

Byju’s supporters contended that since the settlement had been agreed upon and paid for in full prior to the creation of the CoC, they were entitled to request withdrawal under Section 12A of the IBC.

l The Need for IRP and CoC Approval

According to IBC regulation 30A, settlement requests must be approved by the IRP before the CoC is formed. The Supreme Court had previously raised concerns about NCLAT’s ability to circumvent this procedure.

l Equitable Treatment of All Creditors

A central concern voiced by the Supreme Court — especially CJI D.Y. Chandrachud was whether Byju’s could settle with BCCI alone when it had ₹15,000 crore in wider debt.

l Clash with Foreign Lender Rights

Glas Trust, representing U.S. lenders, argued that allowing the settlement undermined the interests of other creditors. Their objection prompted earlier SC actions.

Looking Ahead to July 21, 2025: What’s at Stake

The Court has scheduled the next hearing for July 21, 2025, On that date, the focus will be:

l Whether the settlement should override CIRP and lead to withdrawal.

l Whether due process under IBC — through IRP and CoC — was properly followed.

l Interim relief such as freezing asset sales or continuing the CoC.

The resolution could significantly impact India’s high-value insolvency jurisprudence and set precedent for large debt-laden startups.

Broader Implications for Corporate Insolvency in India

l Establishing Precedents for Settlements

The verdict will clarify whether settlements before CoC formation particularly at the interim stage are legally viable under Section 12A and Regulation 30A versus via NCLAT’s Rule 11 powers

l Equitable Treatment of Creditors’ Rights

Other domestic or foreign creditors, such as Glas Trust, may demand more robust protective measures in subsequent insolvency proceedings if settlements for a subset of creditors are permitted in the middle of the process.

l IRP and CoC’s Guiding Role

The case will establish the standards for IRP participation and CoC authority, reaffirming the necessity of open and methodical conduct in insolvency proceedings.

l Investor Trust in the Startup Environment

As India’s technology startups increasingly engage in large debt deals, clarity in insolvency laws is crucial. The SC decision might recalibrate lender confidence and willingness to invest in high-growth edtech and other sectors.

Conclusion

A multi-million dollar test case at the nexus of prompt resolution, procedural compliance, and equity for all creditors, Byju’s bankruptcy story is more than just a corporate default. In view of the July 21, 2025, Supreme Court hearing, India’s insolvency system is being scrutinized. The case might create stricter rules for startup debt resolution and reinterpret how settlements are handled during insolvency.

Keep an eye out for a significant court ruling that could change the dynamics of startup finance and insolvency law in India.

About Author

Nitya Jain, a law student at Symbiosis Law School, Pune, is an emerging legal writer with a keen interest in the intersections of tort law, contract law, and constitutional law. With a strong academic background, Nitya explores contemporary legal issues through writing, research, and active participation in moot court competitions. Passionate about issues like women’s rights, environmental governance, and the nuances of the Indian legal system, she seeks to contribute valuable insights on pressing legal matters.